Real Estate Opportunities Outpace Demand

Best Seller’s Market since 2007

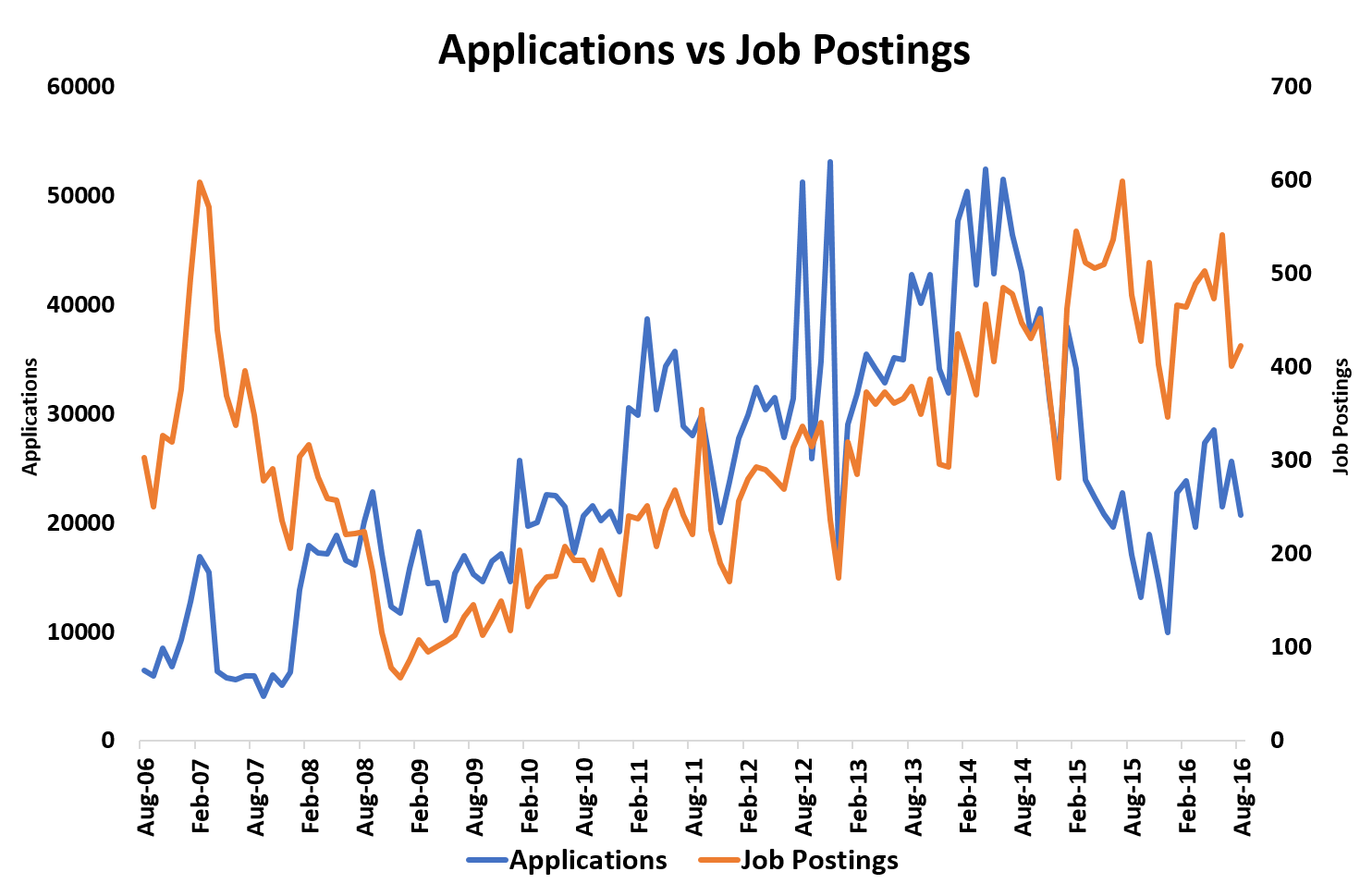

It has been almost ten years since the SelectLeaders Job Barometer witnessed the high water mark in commercial real estate (CRE) job postings during Spring 2007, but hiring activity in 2015 and 2016 has approached those record levels. Applications to commercial real estate openings beginning in 2015 have fallen dramatically to lows last seen in – you guessed it – 2007. The demand-supply gap in commercial real estate signals good news for job seekers and an increasingly heated battle for talent for commercial real estate employers.

“Labor supply to commercial real estate, because of its complexity and opacity to those outside the industry, is relatively inelastic, and many of those displaced from commercial real estate starting in 2008 have either found their way back in or permanently left the industry,” said Dr. David Funk, Managing Editor for the SelectLeaders Job Barometer, adding “the reality is a finite part of the workforce is pursuing a career in commercial real estate at any given time and the industry’s bench depth now mirrors that prior to the global financial crisis.”

From 2008 through 2014 the growth in applications from job seekers significantly outpaced CRE job opportunities resulting in a strong employers market. Today commercial real estate has arguably returned to a job seekers market with applicant-to-job ratios returning to the relative optimistic odds job seekers last experienced prior to the global financial crisis (see Exhibit I).

At the peak of November 2012 a commercial real estate job opportunity averaged over 200 applicants compared to just 30 applicants in 2007. Today employers are averaging 49 applicants for each posting. “There has been a surge in companies seeking technology and software skillsets across all job functions but a shortage of applicants possessing those specialized skillsets,” said SelectLeaders CEO Susan Phillips, adding “For those applicants with strong technology and analytical expertise, though, it has catapulted them along the commercial real estate career track. Tech-savvy analysts are increasingly rotated through asset and portfolio management, acquisition and development gaining experience far beyond their years.”

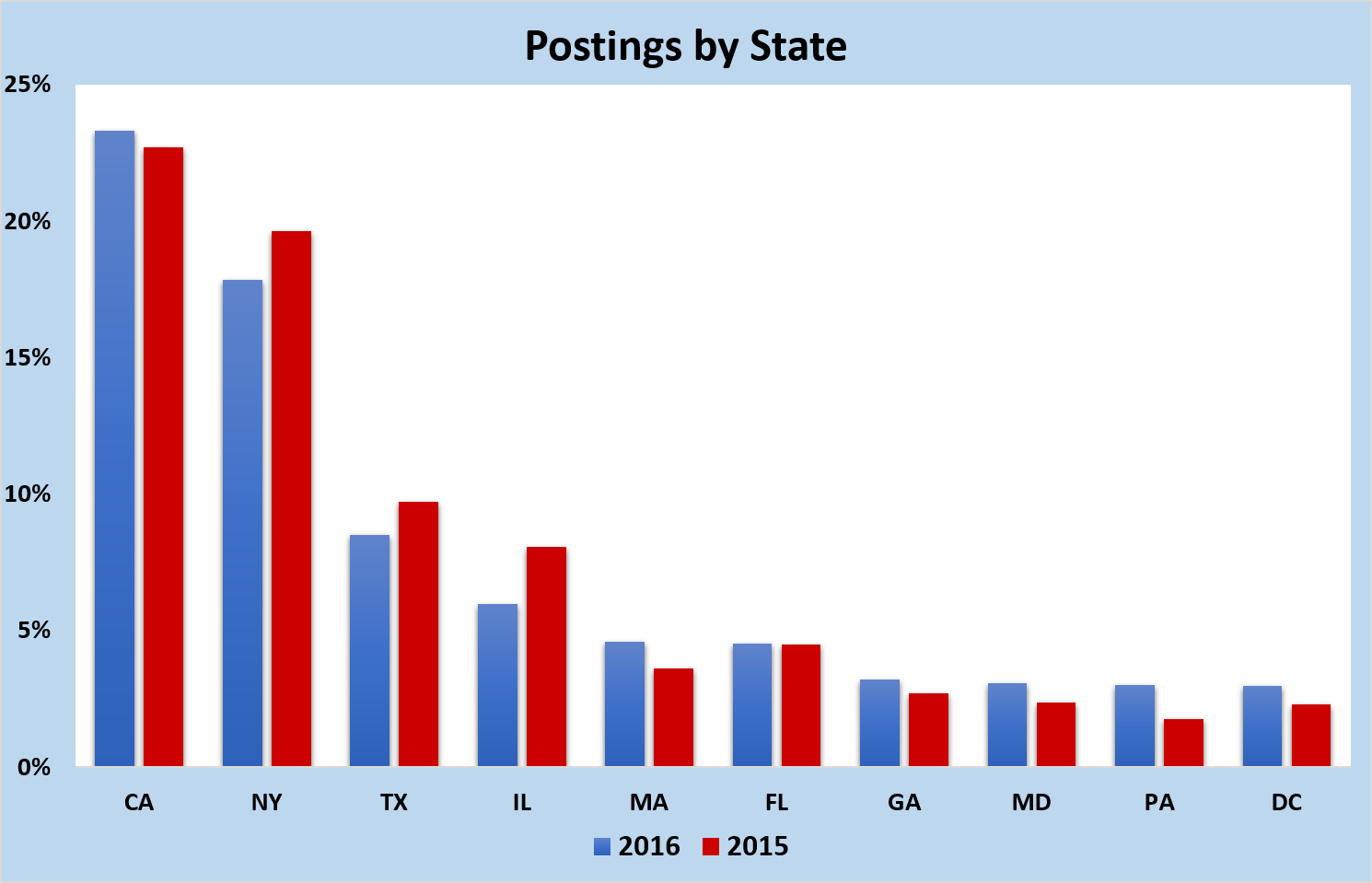

For those seeking to break into commercial real estate it helps to know what fields are the most competitive as well as what states have gaps in talent. California continues as the state with the most commercial real estate job opportunities followed by New York and Texas, and there are almost twice as many CRE job seekers in NY as in California. New York has 61 CRE job seekers for each job available in the state, while in Oklahoma the same number of jobs exist as there are CRE job seekers.

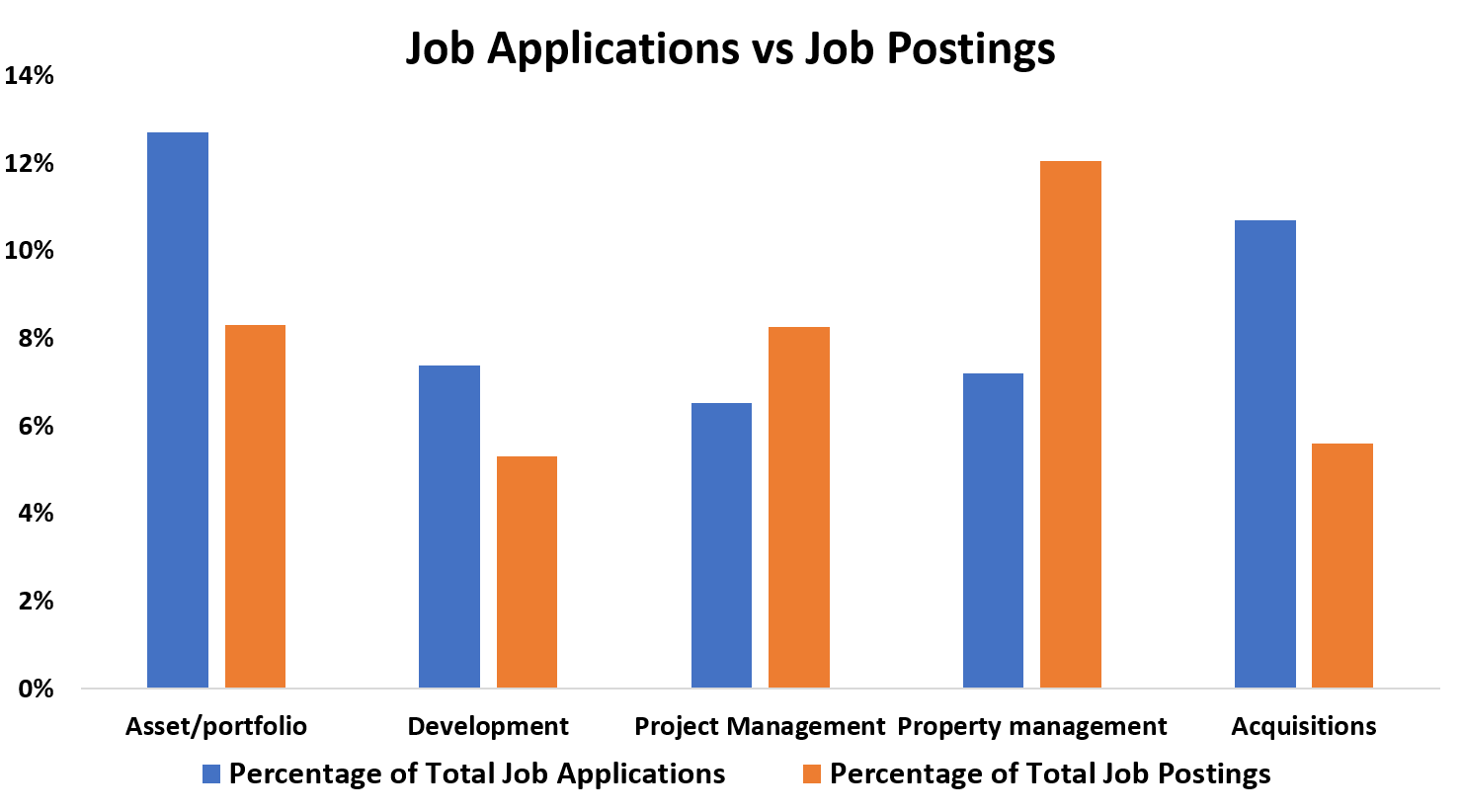

Those seeking to enter the industry are well-served by understanding the relative competitive for jobs geographically across the US and in respective fields, said Funk. “At its most extreme (in 2007) we were seeing over 500 applications for each real estate private equity posting versus 30 applications for property management jobs,” noted Funk. 2016 saw acquisitions as the most competitive job field, which attracted an average of 188 applications for each position, while accounting and controller with 37 applications provided the best odds.

Applications to the job fields with the most openings reflect varying degrees of competition among job seekers. Acquisitions constitutes 5% of all job postings yet receives over 10% of all applications, while property management is the inverse – 12% of all jobs are in property management but that job field only receives 7% of all applications.

Job opportunities in Finance and Investments constitute over 23% of all commercial real estate hiring followed by property management and asset/portfolio management. Development, a perennial career interest particularly among students pursuing real estate undergraduate and graduate degrees, continued to represent over 5% of all job opportunities. Hiring development talent is particularly strong in multifamily and industrial, and redevelopment activity across sectors makes 2016 one of the more opportune times to make a career move into development since the Job Barometer started tracking the industry.

The current hiring climate finds job seekers, savoring the “seller’s market,” being picky about where they even apply. In 2015 sixteen candidates would click on a job for each resume submitted. Thus far in 2016, an average of twenty-four job seekers will visit a job posting for each application submitted. These numbers are far below 2007, though, when job seekers were ultra-choosy — 54 visitors for each resume submitted – and salaries rose accordingly.

Hiring in commercial real estate has been strongly correlated with GDP growth over the past decade, and has typically functioned as a leading indicator for the overall economy. “The dip we saw in hiring activity this past spring was cause for concern, but the pace of hiring activity in late summer and through the fall is off the pace of 2015 but still healthy,” said Phillips.