SelectLeaders Real Estate Employment Cycle

Helps Identify Where We are in the Market

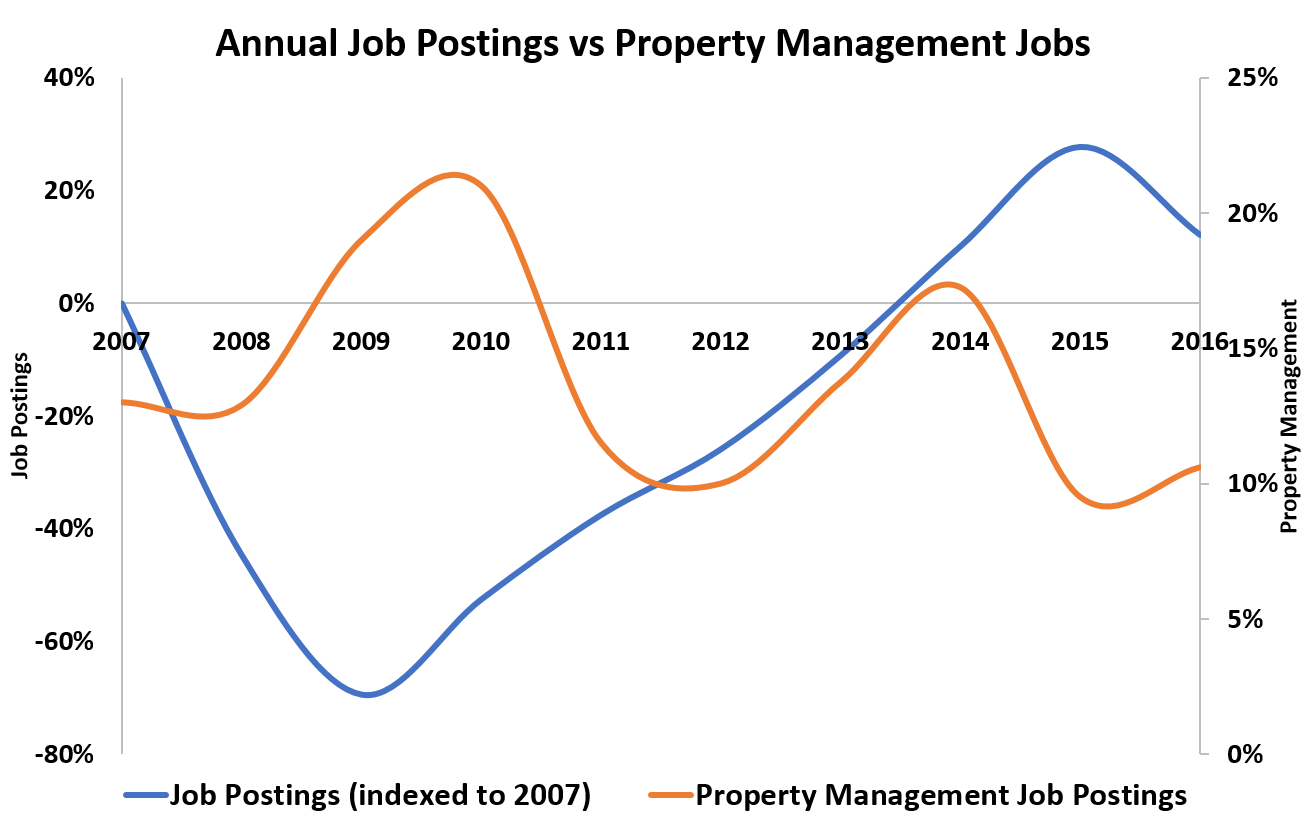

New York, NY. – Overall US employment continued its five-year run of momentum into 2017, yet a reduction in commercial real estate jobs hints at uncertainty and a looming potential pullback in hiring. Commercial real estate hiring tends to be a leading indicator of the larger employment market, and just as CRE jobs fell off in early 2007 in advance of the larger market correction so too do the last six months of 2016 warn of weakness, reports the SelectLeaders Job Barometer.

Commercial real estate job postings fell 38% from May 2016 through the end of the year with a reversal of the trend in January. “Commercial real estate employers became tentative in their hiring starting in mid-2016, and the question is whether the reversal we saw in January is a temporary blip or a true reversal in confidence,” said Dr. David Funk, Managing Editor for the SelectLeaders Job Barometer, adding “Development-related jobs continued to decline adding credence that employers may feel the cycle is heading towards the retrenchment stage.”

Commercial real estate hiring does exhibit a “January Effect” where job posting tend to jump in January and then fall off in the spring before jumping again during the fall hiring season. “Hiring budgets and the slow down during the holiday season certainly impact this hiring trend that has held relatively consistent since we began tracking the data,” said Susan Phillips, CEO of SelectLeaders.

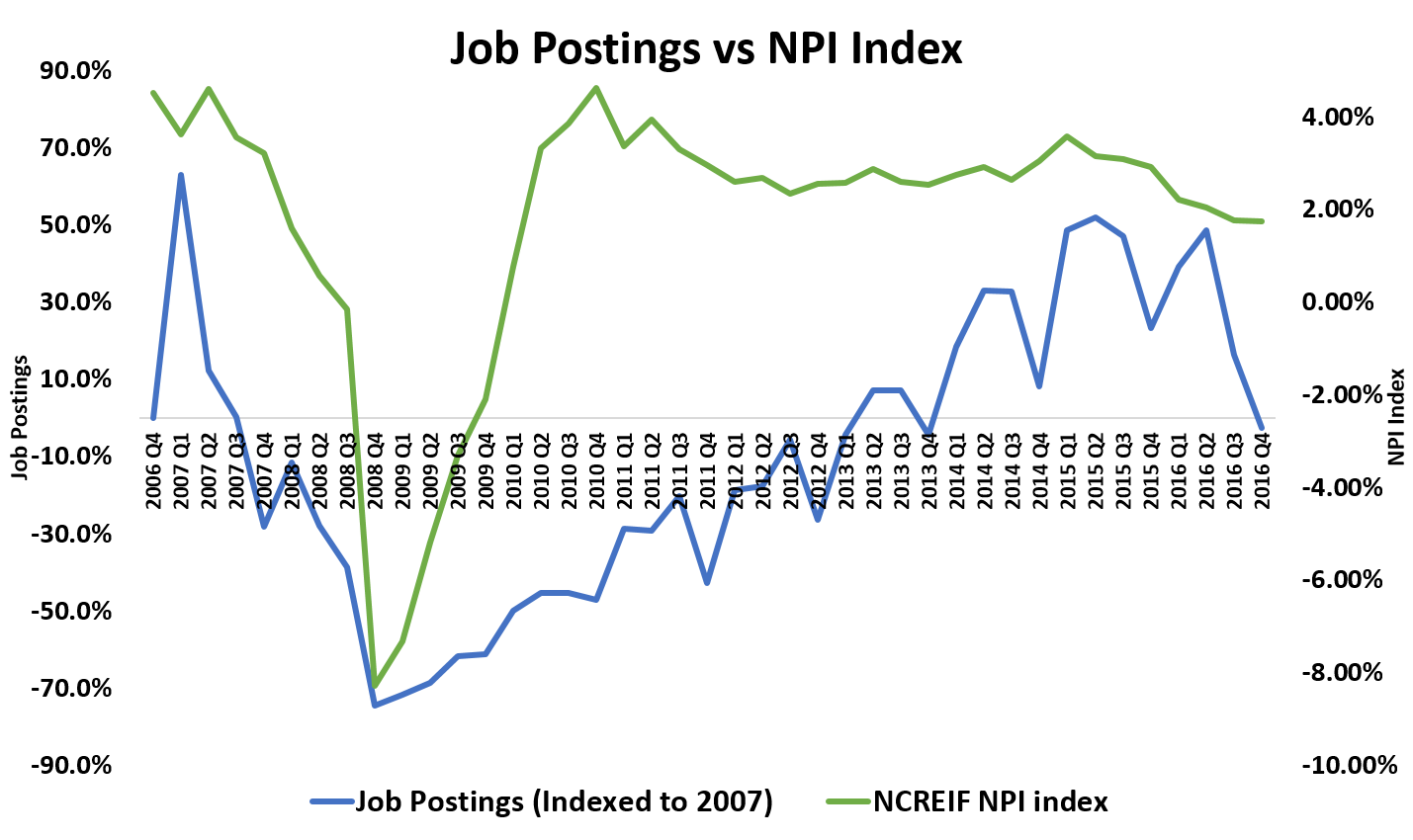

The SelectLeaders Job Barometer research, which has tracked the employment opportunities, trends, and hiring practices in the commercial real estate industry since 2006, has revealed a discernable cycle of commercial real estate employment activity that mirrors real estate market cycles. The NCREIF Property Index (NPI), which represents quarterly, unleveraged returns on private commercial real estate investment property, serves as a proxy for the real estate market cycle and when compared to CRE job postings reveals job postings are a leading indicator of real estate market corrections yet lag recoveries. “Commercial real estate values and returns bounce back much more quickly than jobs, while employers’ decisions to pullback on hiring often tells us the direction the market is heading,” said Phillips.

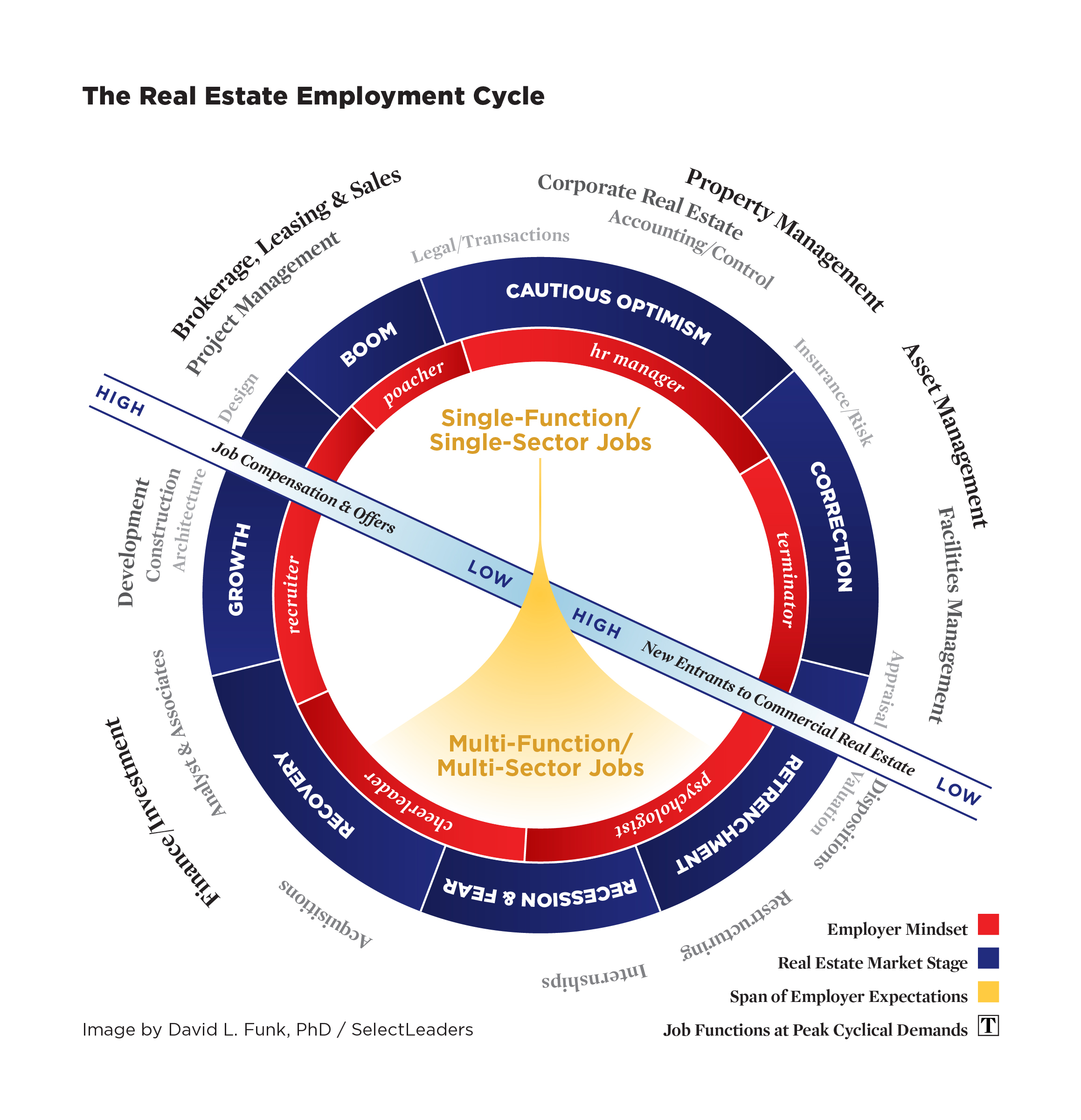

The SelectLeaders Job Barometer research into CRE employment activity and trends has resulted in the development of the Commercial Real Estate Employment Cycle as a resource to understand real estate employment dynamics. Debuting in this report, the Real Estate Employment Cycle identifies seven real estate market stages that correspond to distinct hiring activity as well as five employer mindsets the evolve during a full CRE employment cycle. Specific job functions, meanwhile, such as development, asset management, and acquisitions experience peak hiring demand based on stages in the cycle.

“Our decade-long research into CRE employment activity has revealed a clear connection between employers’ mindsets, the span of their expectations in new hires, and the nature of jobs they post based on where we are in the cycle,” said Funk. Toward the top of the cycle employers tend to hire for niche job functions in specific sectors, such as a multifamily acquisitions specialist, whereas at the retrenchment and recovery stages hires are expected to fulfill multiple job functions across more than one sector.

“The pace of hiring and the nature of the job postings that we are seeing predominate now argues that we are at the Cautious Optimism stage in the CRE Employment Cycle,” said Funk, noting that current activity could indicate slow growth and stability rather than a transition into retrenchment.

Not surprisingly, a close correlation exists between increasing job offers and compensation as the market cycle moves from recovery to boom while at the same time the employer mindset evolves from that of cheerleader to recruiter to poacher during the up cycle. “We”ve also found that new applicants to commercial real estate, that all-important pipeline of talent, drops dramatically during the retrenchment through recovery stages,” said Phillips, noting that such swings in new entrants can create talent gaps that endure for years.

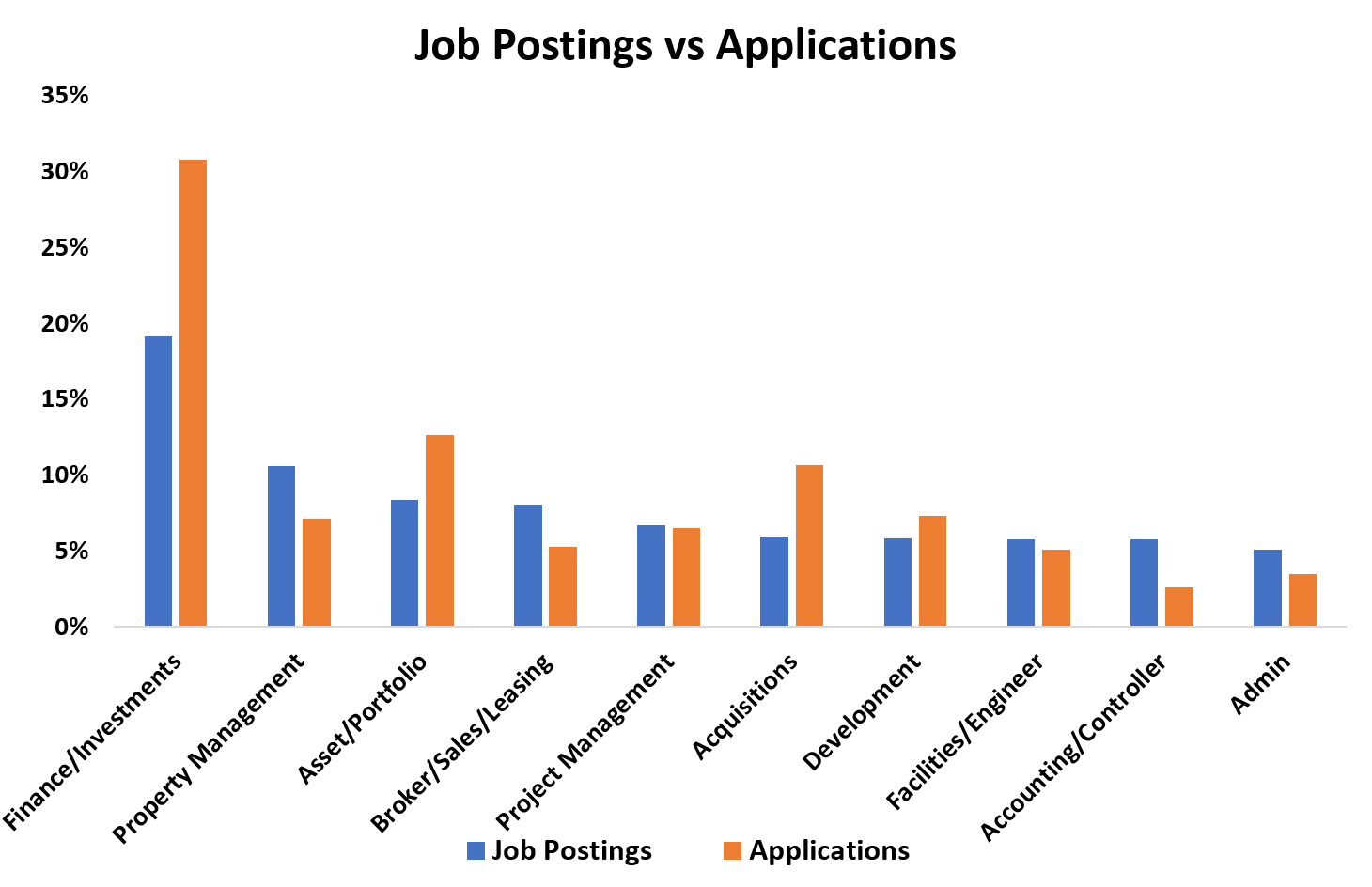

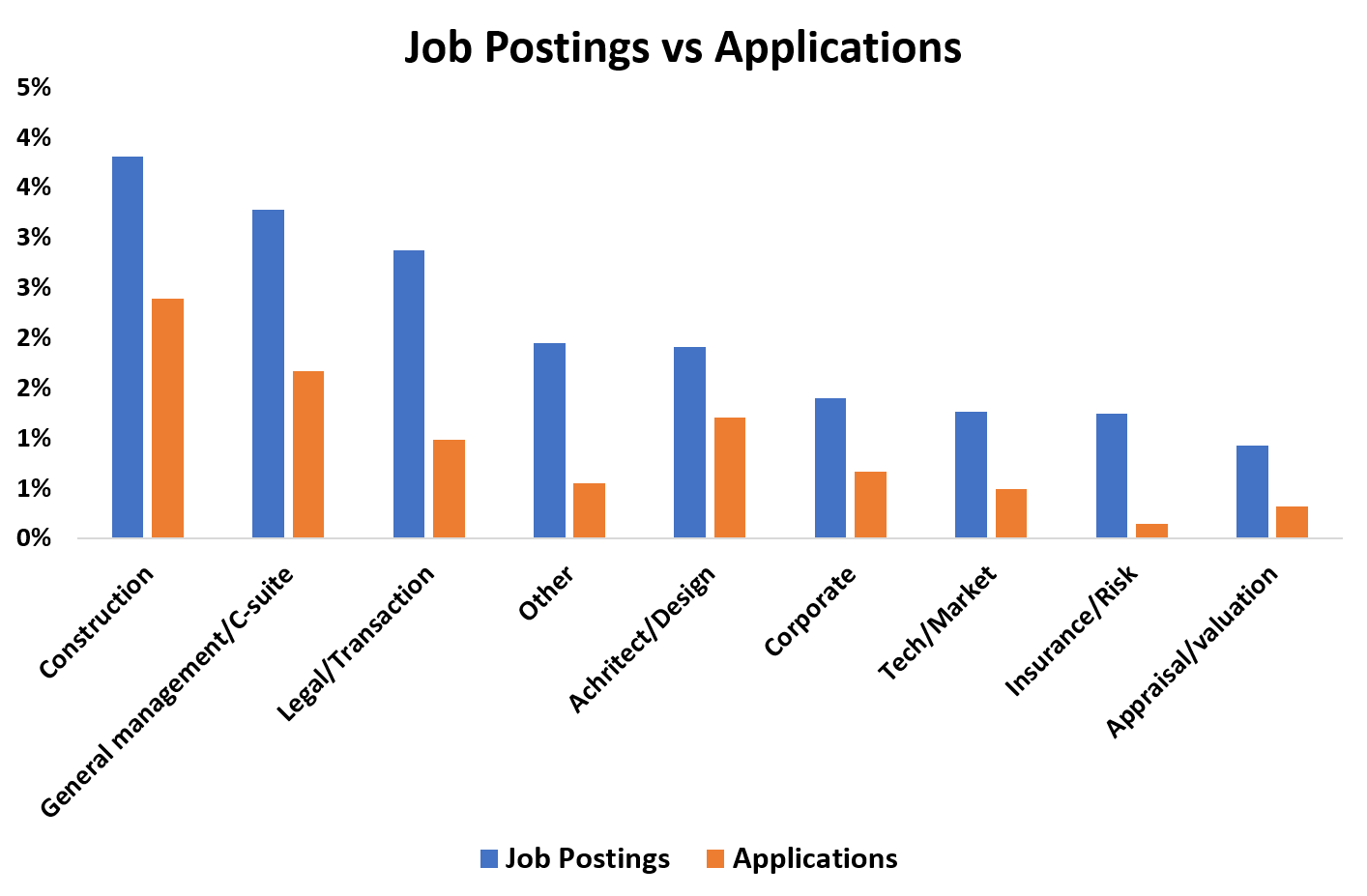

Certain jobs remain mainstays of commercial real estate hiring even though they will fluctuate in relative terms during market cycles. Finance/Investment, Property Management, Asset Management, and Brokerage/Sales were the top four CRE job opportunities during 2016. Applications traditionally do not match job opportunities, however. The Job Barometer has been tracking the mis-match between jobs and applications since 2006, and finance/investment and acquisitions jobs historically receive the greatest applicant demand. Acquisitions positions represent 5% of all CRE job opportunities yet receive over 10% of all applications submitted.

“It is a recurring theme that if job seekers can recognize some of the demand/supply gaps in real estate hiring they can enhance their prospects,” said Funk.

Where does the supply/demand ratio favor the job seekers? Property management, legal/ transactions, and corporate real estate are relatively welcoming, and if you have interest in Insurance/Risk management please apply.

Research on the Real Estate Employment Cycle identified where in the cycle a job function will be at its maximum % of all job postings, which can provide insight into where the cycle is moving based on job postings. Acquisitions reaches its peak hiring stage during the growth stage, for instance, while property management hiring is countercyclical and peaks when CRE is in retrenchment.

While the Real Estate Employment Cycle is in the 7th inning stretch, many believe the new tax code and infrastructure spending will be home runs and forestall a correction stage. Could they propel “Cautious Optimism” to go into extra innings slowing down the real estate cycle? “So far so good for CRE 2017 hiring activity,” added Phillips.